52+ can mortgage insurance premiums be deducted in 2019

For federal purposes taxpayers who choose to itemize deductions are allowed to deduct certain. Be aware of the phaseout limits however.

How Do You Calculate Mortgage Insurance Home Loans

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other.

. Web You cannot add the mortgage insurance premiums to the mortgage interest. Web Homeowners who have sufficient mortgage interest and other qualified expenses to get above the standard deductions of 25900 married filing jointly or. However higher limitations 1 million 500000 if married.

Its included in the entry for mortgage interest. Web The deduction for certain mortgage insurance premiums has been extended. The deduction is reduced AGI above 109000 54500 if married filing.

It will have to go on a separate line on Schedule A but the IRS has not yet. Once your income rises to this level. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

Web Turbotax was updated to allow the deduction for mortgage insurance premiums as of February 22 2018. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. This income limit applies to single head of. When you file your income tax return in 2020 for the 2019 tax year you will no longer be able to deduct mortgage insurance.

Also your adjusted gross income cannot go over 109000. Web Is mortgage insurance tax deductible. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

However higher limitations 1 million500000 if married. Web Adjusted gross income AGI above 100000 50000 for married filing separately. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction.

Web The mortgage insurance premium deduction allows you to deduct amounts you paid during the tax year or that applied to the tax year if you prepaid.

2023 S Best Short Term Health Insurance Consumersadvocate Org

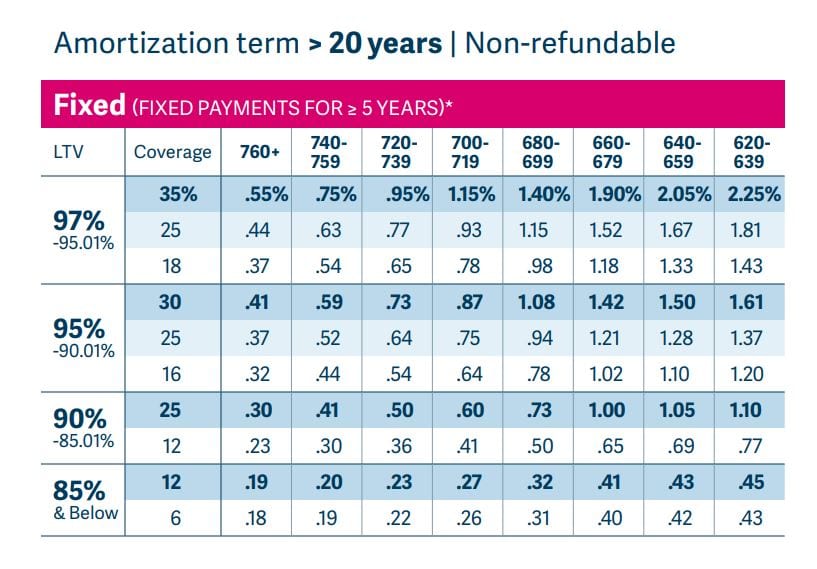

April 2012 The New Fha Mortgage Insurance Premiums Mip Schedule

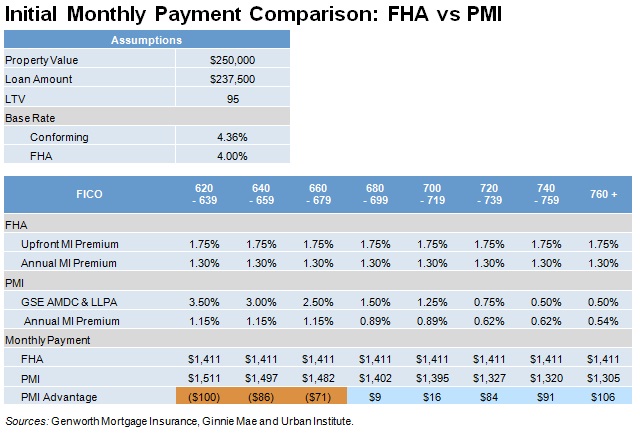

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

Is Pmi Tax Deductible Credit Karma

Top 9 Tax Deductions And Credits For Sole Proprietors

Private Mortgage Insurance How Pmi Works Cnet Money

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Is Private Mortgage Insurance Pmi Tax Deductible

Best Lic Plans To Invest Latest High Return Lic Policies In India Mar 2023

:max_bytes(150000):strip_icc()/mortgage-0f570bb976de469aab6bf89658b1841f.jpg)

When Is Mortgage Insurance Tax Deductible

Is Pmi Tax Deductible Credit Karma

Top 9 Tax Deductions And Credits For Sole Proprietors

Is Mortgage Insurance Tax Deductible Bankrate

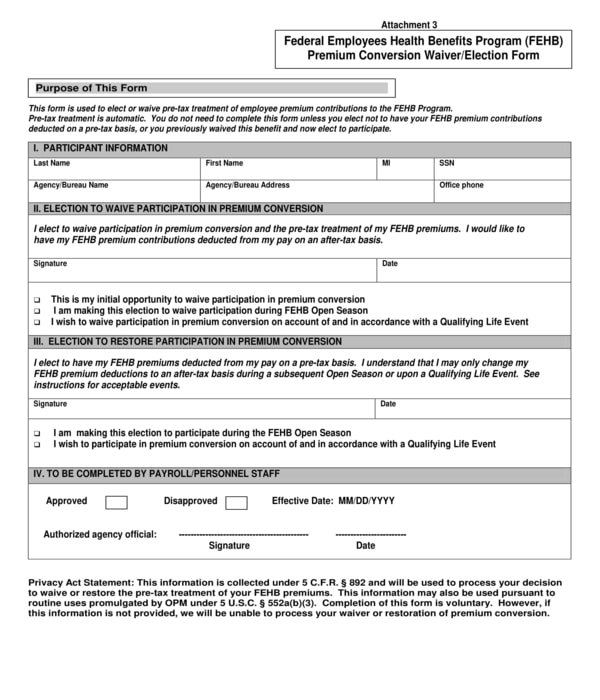

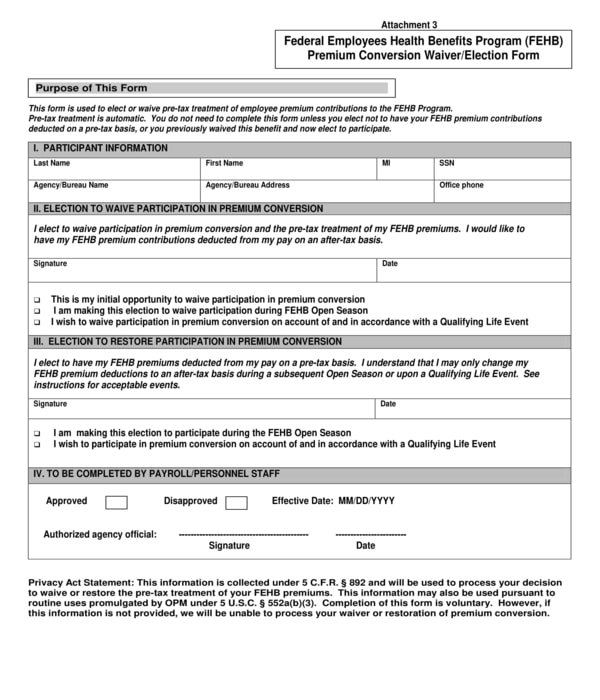

Free 12 Employee Waiver Forms In Pdf

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Can I Deduct Pmi In 2019

Ex 99 2